Gold: Time to buy now?

NEW YORK (CNNMoney)

Gold has been a losing investment for months.

But in the last six days, the precious metal seems to have regained

some of its luster, rising 5.8%. Last week, gold recorded its biggest

weekly percentage gain since 2011, and it came after four weeks in a row

of losses.

Some believe this could be the beginning of a new momentum.

"We're in process of finding a bottom," said Jeff Nichols, managing director of American Precious Metals Advisors.

Since April, investors have

abandoned gold in favor of the stock market, where they have chased higher returns.

The price of gold is

off sharply from the record highs of 2011,

when it touched $1,900 an ounce. Despite its gains this past week, gold

is still down about 24% since the beginning of the year. It's currently

changing hands in the futures market at $1,284 an ounce.

Gold has been pummeled because of

worries over the Federal Reserve

scaling back its economic stimulus policies. Such a move takes away

gold's value as a hedge against inflation. In the years after the

financial crisis and recession, investors had rushed to buy gold because

they bet that the Fed's extensive bond buying would undermine the U.S.

dollar and drive up consumer

prices.

Another big reason why gold has been depressed lately is that economic growth is slowing in

emerging markets, including China and India, both of which are large buyers of physical gold.

Still, some veteran gold watchers say the sell-off presents an

opportunity. Longer term investors might want to bulk up on the metal

because there are no signs that appetite for gold from consumers in Asia

has waned. At the same time, supplies from gold mines remains tight.

Nichols from American Precious Metals Advisors believes that gold

prices over the next three to five years could surpass the 2011 highs.

He stressed, however, that gold buyers need to be patient. "It's not clear we will have a quick turnaround," he said.

Related: Is gold losing its safe haven appeal?

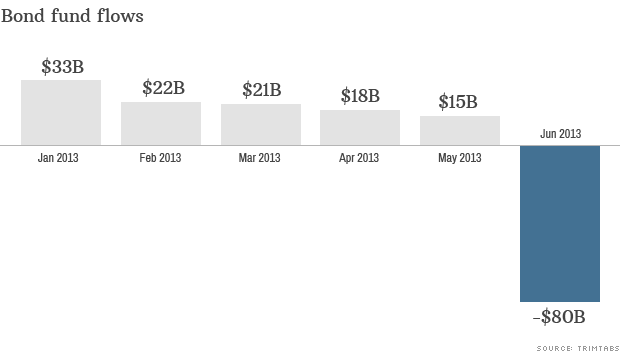

Gold got a boost last week after Fed chairman Ben

Bernanke said U.S. monetary policy will remain "highly accommodative" for the foreseeable future.

The remark lowered expectations that the Fed will begin to cut back on

its $85 billion-per-month bond-buying program this year.

"I

think the Fed is being overly optimistic and won't get around to

tapering this year," said Chuck Butler, president of EverBank World

Markets. "If that's the case, then I think gold will really start to

rebound."

Butler said gold prices could climb back to $1,450 an

ounce if the Fed delays tapering. But he cautioned that the market has

been extremely volatile and that further declines cannot be ruled out.

He noted that the cost to bet against gold, by shorting, has increased

recently. That suggests that speculators are becoming less convinced

that gold is headed lower.

Gold prices in the futures market

are mainly driven by short-term traders, such as hedge funds, that

rarely take possession of physical gold, said Steven Feldman, chief

executive of Gold Bullion International.

But he said demand for physical gold, including bars and coins, has been strong in China and other Asian markets.

Related: Gold bugs regain some swagger

Feldman said the fundamentals of supply and demand should push gold higher over the long term.

Despite an expected slowdown in China, he said demand for physical

gold, including jewelry, should remain robust in the world's second

largest economy. In addition, he said gold should continue to benefit as

global central banks look to diversify their reserves.

Meanwhile, gold supplies have tightened.

Feldman said miners are "under siege" in some parts of the world as "resource nationalism" is on the rise.

"I'm very bullish long term based on the fundamentals," he said.

"Supply isn't going to go up, and demand is strong as China continues to

grow, central banks diversify and investors warm up."

First Published: July 16, 2013: 1:49 AM ET